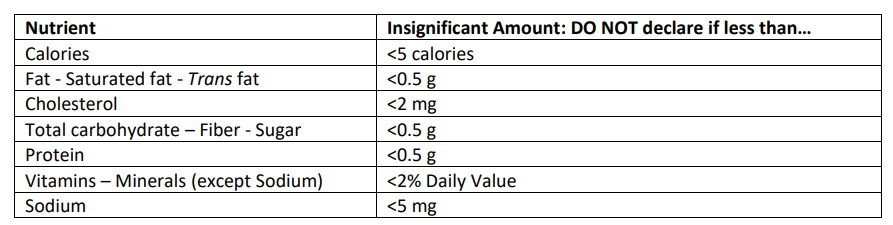

The food labeling regulations at 21 CFR Part 101 define significant amounts for each dietary ingredient (vitamin, mineral) that has a Daily Value (DV) or a Reference Daily Intake (RDI). On Dietary Supplement labels, amounts below the significant amount should not be declared. This is different from food labels (Nutrition Facts) where certain mandatory ingredients must be declared even if they are zero. The nutrients that have DVs or RDIs are collectively referred to as “(b)(2)” dietary ingredients because that’s the regulation they appear under.

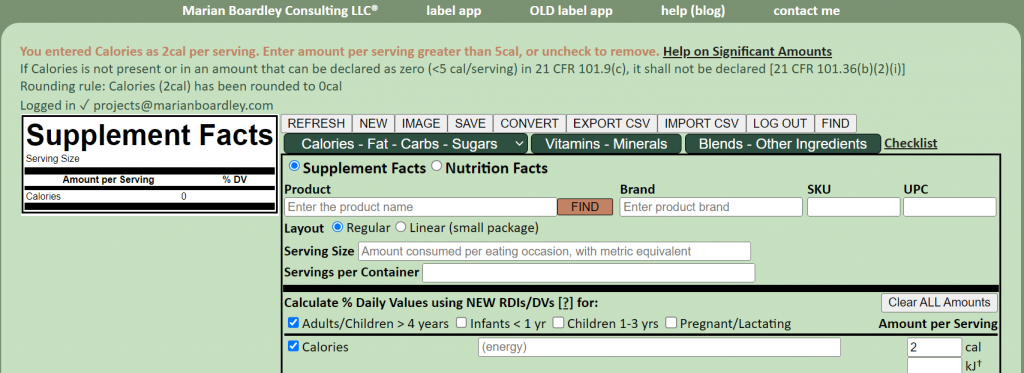

At present, the application calculates whether the amount you entered is below the significant amount, and if so, declares it as zero on the label. You’ll see messages telling you about this situation when you refresh the Supplement Facts panel. In most cases, you should remove the item from your Supplement Facts by deselecting using the checkbox. This is not done automatically, and you may need to check and update the label when this situation occurs.

21 CFR 101.36(b)(2): Information on dietary ingredients that have a Reference Daily Intake (RDI) or a Daily Reference Value (DRV) as established in § 101.9(c) and their subcomponents (hereinafter referred to as “(b)(2)-dietary ingredients”). (i) The (b)(2)-dietary ingredients to be declared, that is, total calories, total fat, saturated fat, trans fat, cholesterol, sodium, total carbohydrate, dietary fiber, total sugars, added sugars, protein, vitamin D, calcium, iron, and potassium, shall be declared when they are present in a dietary supplement in quantitative amounts by weight that exceed the amount that can be declared as zero in nutrition labeling of foods in accordance with § 101.9(c). Calories from saturated fat, polyunsaturated fat, monounsaturated fat, soluble fiber, insoluble fiber, and sugar alcohol may be declared, but they shall be declared when a claim is made about them. Any (b)(2)-dietary ingredients that are not present, or that are present in amounts that can be declared as zero in § 101.9(c), shall not be declared (e.g., amounts corresponding to less than 2 percent of the RDI for vitamins and minerals).